Futurize Your Customs Clearance Operations with AI/ML-Powered Automation

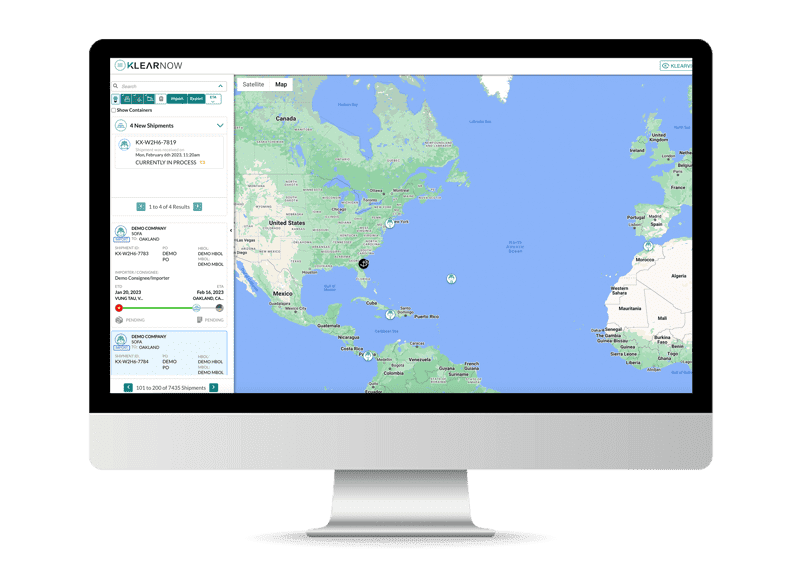

Experience the future of customs and drayage management with KlearNow.AI. Streamline your clearance workflows and gain global control-tower visibility.

Our cutting-edge AI/ML-powered technology is designed to transform the customs clearance and drayage management process, giving you back valuable time and resources. We don’t need complex integrations, starting with a simple email, we integrate all your trading partners. Our sophisticated AI/ML tools take over, structuring and contextualizing your data into a single, easy-to-manage platform.

Cost-Effective Efficiency: Reduce data entry and file handling expenses by over 90%, allowing you to reallocate funds where they matter most.

Precision and Accuracy: Say goodbye to manual errors with a 99% accuracy rate in transforming complex, unstructured data into clear, actionable information.

Scalability and Growth: Boost your team’s productivity 10X, unlocking new opportunities for growth and expansion without the need for additional resources.

Savings Calculator: Witness the tangible benefits with our savings calculator and make informed decisions that propel your business forward.

NUMBER OF

EMAIL chains SCANNED

NUMBER OF

DOCUMENTS INGESTED

NUMBER OF

customs lines processed

SOLutions to YOUR CURRENT CHALLENGES

INTEGRATED WITH CUSTOMS

- Certified ABI-customs software provider

- Customs clearance status notifications

- Manage events & exceptions asap

- Receive CBP (7501) receipt on platform

- Available in UK, Canada, Spain and Netherlands

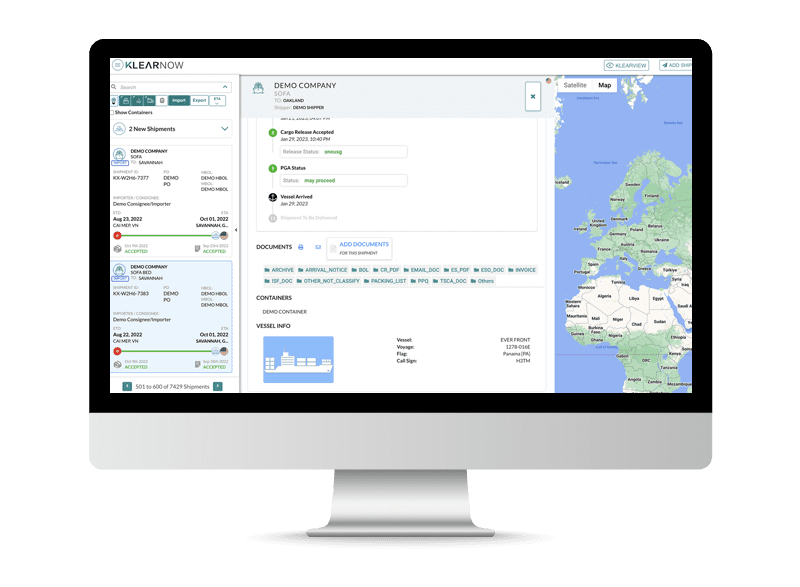

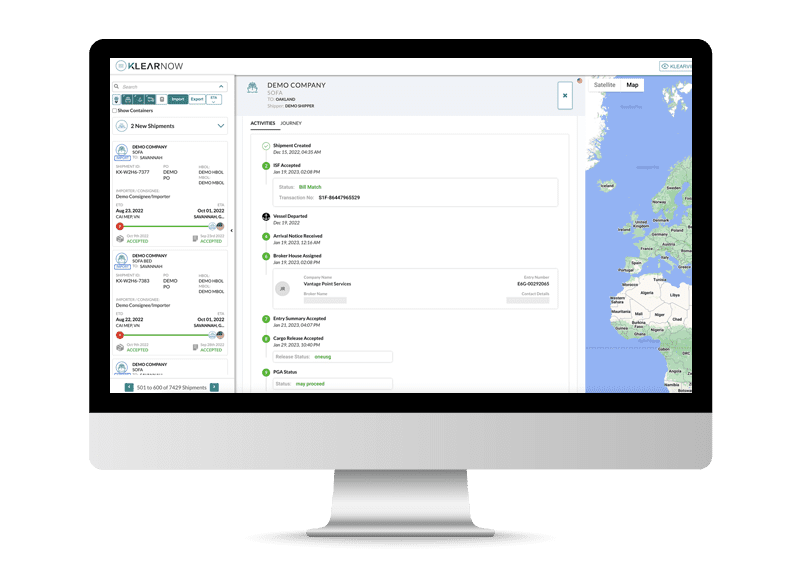

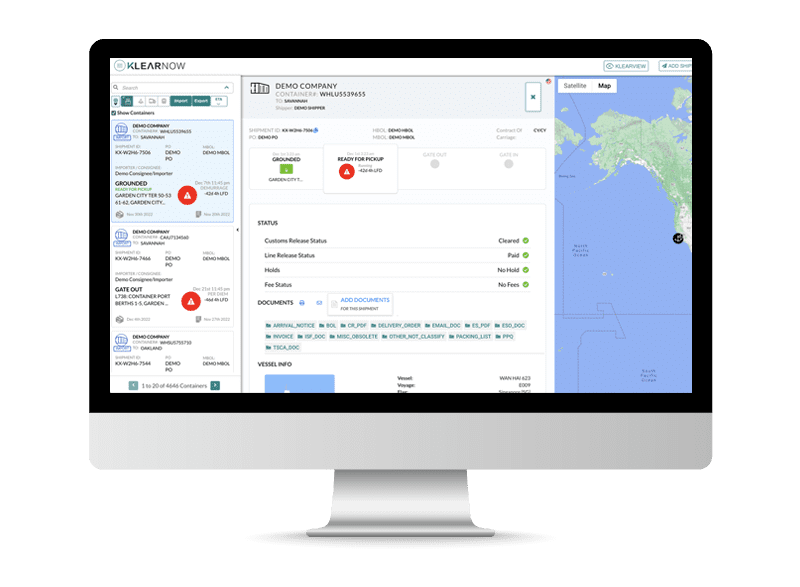

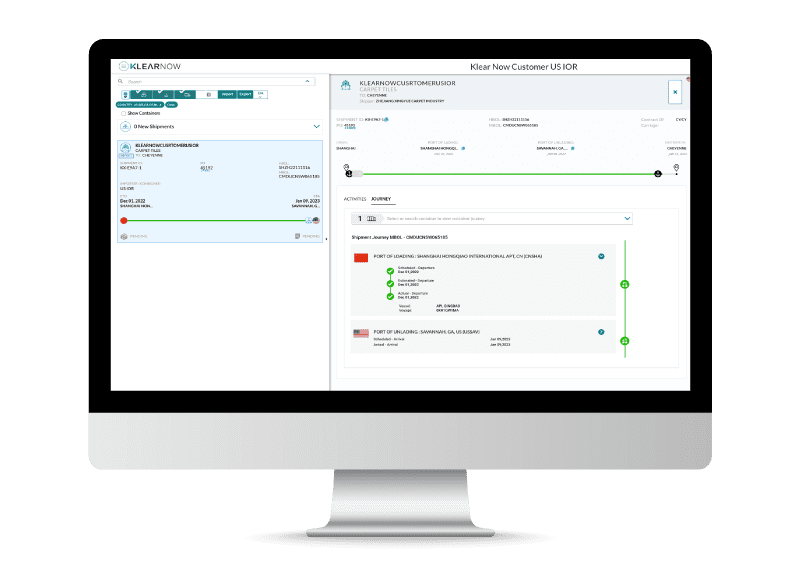

Easily Track Containers

- Carrier agnostic platform

- Location & condition data available on-demand

- End-to-end track & trace

- Visibility into port & customs activities

- Intermodal activities

eliminate data entry

- 24/7 data ingestion and insights using AI & ML

- No more manual data entry, entry in mins vs hrs

- Remove human errors via automated data entry

- Continuous learning AI engine

- Digital data anytime anywhere

INTEGRATED WITH CUSTOMS

- Interactive data among partners

- Seamless communication among partners

- Stay in the KNow among partners

- Automated workflows

REDUCE OPERATIONAL COST

- Eliminate email chains & phone calls

- Gain data-based insights via reports & analytics

- Optimize teams

- Documented communication among partners

- Cut costs, save time & the planet

.

Global Compliance

- Licensed customs broker network

- IOR & Customs broker direct relationship

- Accurate HS classification from Master Data

- Real-time access to customs status

- On-demand trade documents for 5 years

BEST IN CLASS customs clearance software

Global Supply Clarity and Insight with AI

KlearHub is a cloud-based platform that digitizes and contextualizes unstructured trade documents to create shipment visibility, business intelligence, and advanced analytics for supply chain stakeholders.

- Document Management and Storage

- Near Real-Time Visibility

- Customizable Dashboards with Advanced Analytics

- Simple Email Based Integration

Automate your trade document processing

Data Engine is an AI/ML-powered platform that processes unstructured documents, converting them into structured data and transmitting them back to your system. Our Data Engine has been learning since 2018 and has accumulated exceptional knowledge providing higher accuracy.

- Ingest trade documents in any format

- Flexible data outputs

- Configurable Business Rules

- Automated validations

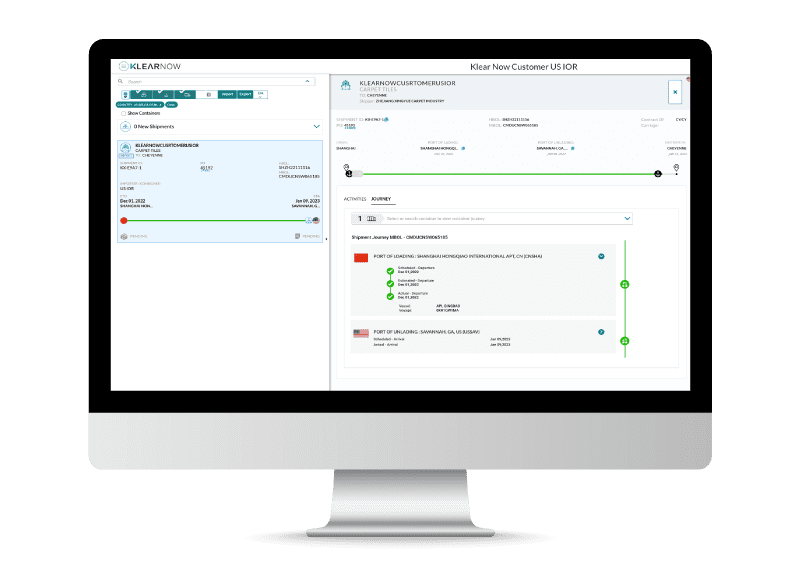

Simplify complex customs clearance with automation

A digital platform to handle shipping documents and customs clearance of any scale or complexity. ABI-certified software vendor with direct integration to Customs authorities in the US, and CA, UK, ES, NL.

- Filing customs authorities on platform

- Customizable reports using natural language

- Comprehensive visibility including customs clearance status

- Transform unstructured documents into meaningful data using AI

FULL SERVICE CUSTOMS BROKAGE & DRAYAGE

Customs360 – Digital customs clearance service for your international shipments

A full-service model for customs clearance with our broker partners or KlearNow.AI brokers leveraging the cloud-based platform for customs clearance operating in five countries (US, CA, UK, ES, and NL)

- Intelligent gathering and processing of shipment documents with AI/ML

- Customs Brokerage Services by KlearNow.AI

- Monitor detention and demurrage with built-in clocks and dashboards

- Comprehensive visibility from origin to destination

- Customizable reports and In-platform billing and invoicing

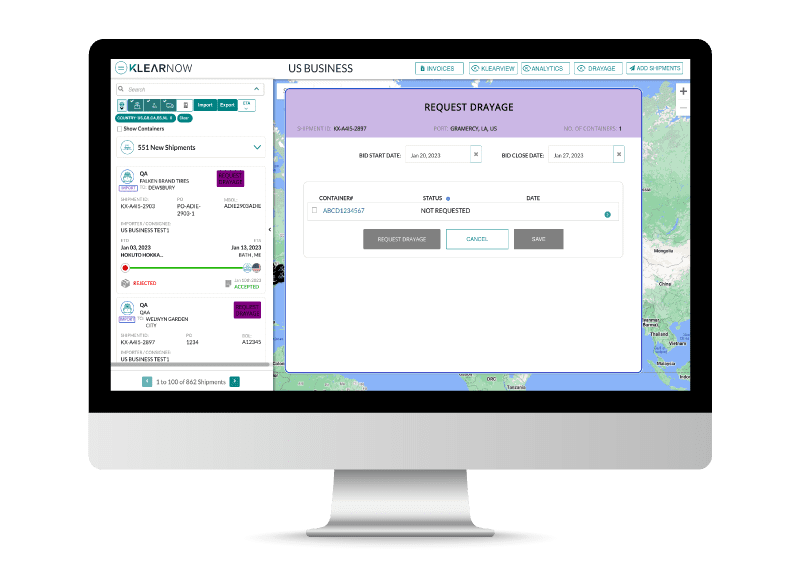

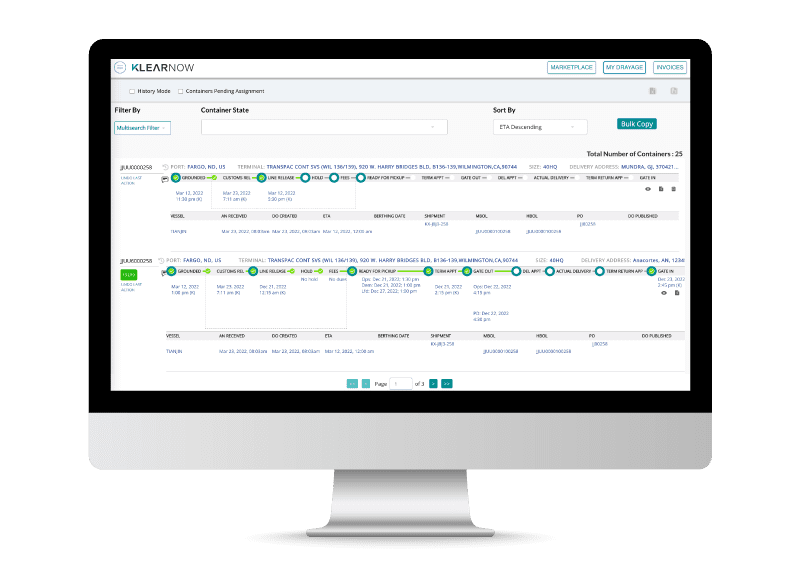

Drayage360 – Digital drayage management service for your dray moves

A single platform to book, track, and manage drayage. Full-service drayage management by the KlearNow.AI team. Drayage360 works best in concert with Customs360/Customs Engine.

- Access a marketplace with dray providers at any port in the US

- Plan your drayage weeks in advance

- Intelligent processing and digitization of shipment documents with AI/ML

- Comprehensive end-to-end visibility on a single platform

- Digital signature for documents like proof of delivery

- In-Platform Billing & Invoicing

Discover how KlearNow.AI can work for you

Stay connected with your cargo, your partners and your customers. Digitize customs clearance documentation from all your partners in one global platform. Our AI & ML technology has been learning since 2018, so you can now do more business at a lower cost with full transparency. Discover how we can improve your supply chain today.

Importer

Importer

- Speedy ISF + Customs Clearance filing (cargo release & entry summary 7501)

- End-to-end track & trace and visibility of customs & port activities

- Compliant with CBP electronic record requirement

- Integrated drayage solution

- Live notification updates, reporting & analytics

- Eliminate siloed software expenses

Customs Broker

Customs Broker

- Work at 10x your speed by automating data entries

- Collaborative communication via platform

- Eliminate emails and calls made per entry

- Receive live responses from CBP

- Zero set-up fees and work from anywhere, anytime

- Wow customers with digital shipment status, tracking and reporting

NVOCC / FF

NVOCC / FREIGHT FORWARDER

- New customers overnight & eliminate customs function with us

- Eliminate customer service function from operations

- Stay compliant & streamline operations by automating document digitization

- Superior compliance & system of record provided to your end customers

- Monitor and gain real-time visibility into the status of your freight & associated documents

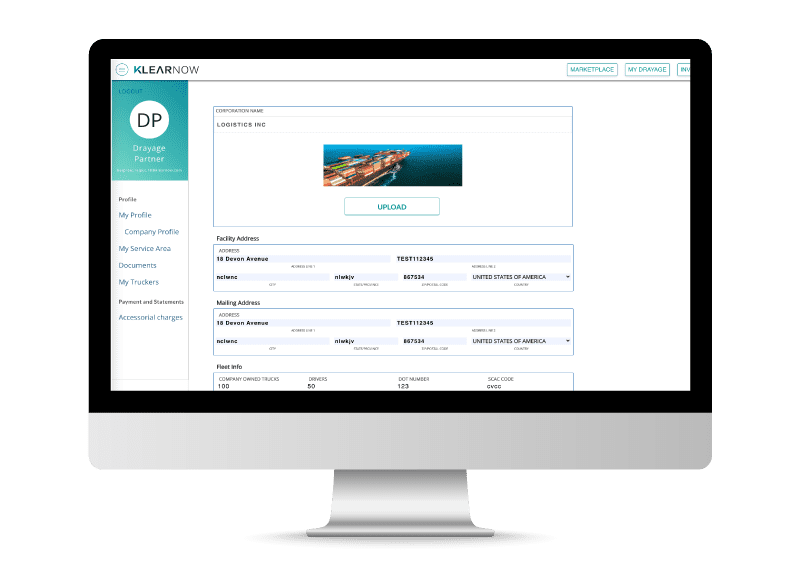

Drayage Provider

Drayage Provider

- Maximizing fleet optimization with our platforms business

- No sales needed; customers brought to you

- Quick payments & top customer service

- Easy documentation via digital capture

- Zero implementation costs

THE KLEARNOW.AI RESULTS

CONTROL COST, IMPROVE PROCESS & BLOW YOUR CUSTOMERS’ MIND

Unlock efficiencies across your business and let your staff do the things that matter, like making your customers happy.

90%

reduction in data entry costs for our +1500 clients

99.9%

unstructured data in – structured data out

66K

different trade document formats ingested

10x

increase in customs entry filings by existing staff

See Why 2000+ Companies Choose KlearNow

Visibility

Dynamic, mapped port-to-port visibility.

Ease of use

A copied email or data transfer starts the process automatically.

Document Management

Essential digitised documents automatically saved on platform for easy retrieval for compliance or audits.

Customs Transparency

See actual comments and replies from CBP for faster issue resolution.

Entirely web-based

No software downloads or IT integrations required, but API and EDI available as needed. Ready out of the box solution.

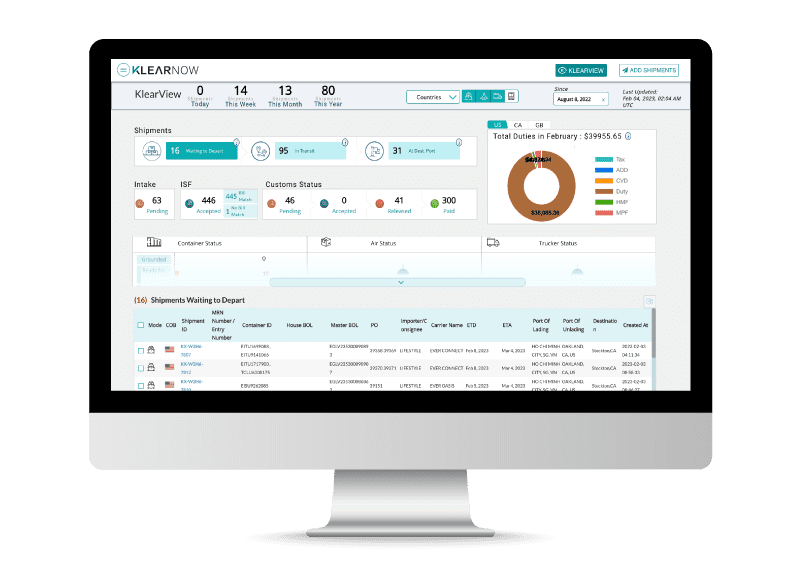

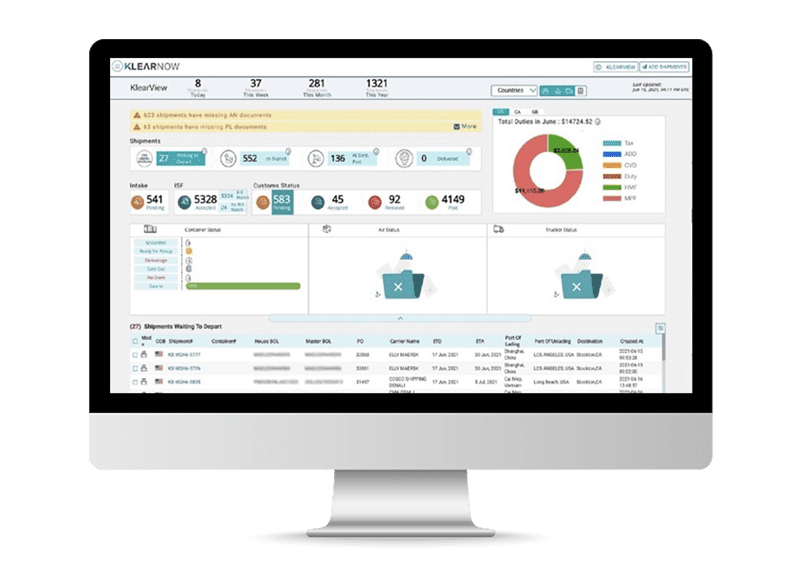

KlearView dashboard

Consolidated view of all import data that matters to customers.

Demurrage counter

Prioritise loads to pick up and eliminate demurrage & per-diem charges.

Drayage management

Platform built to further relieve demurrage and equipment issues at the port.

Reporting

Custom reports delivered per customer data & frequency specifications.

Flat fee pricing structure

Entries charged at the same rate, no matter the complexity.

CLIENT TESTIMONIALS

Track with real – time visibility

Enable new levels of cargo visibility & productivity that reduces logistics costs and creates better customer experiences. See how it all comes together. Pay per use. No integration required. Sign-up in minutes and go!

Client TestimonialS

KlearHub has been a game-changer for our operations. It eliminated frictions in our supply chain, reduced delays, and provided unparalleled customer service. I highly recommend KlearNow AI’s innovative solutions, especially KlearHub, for any global manufacturing company seeking transformative improvements.

Vice Chairman, UFlex

Prior to KlearNow.AI it took the team 15 to 30 minutes per shipment on average and now with KlearNow.AI we just review a couple of minutes and done. We eliminate errors, data entry and stress to our day.

Head of Customs GDAR, a Tudefrigo Company

Using the platform we are able to manage the entire process, and complete all the paperwork, saving both us and our customers time and money. We selected the best customs brokers and tools with KlearNow.AI providing the fastest clearance with digital docs & compliant data on hand

Carola Trading Ltd., UK

KlearNow have been incredibly patient and helpful with guiding us through the new customs paperwork and requirements needed in order for us to continue to export.

Laura Jackson, Director of The Popcorn Company

KlearNow has provided us with a robust solution to accelerate customs clearance procedures. Their support team and customer onboarding process were friendly, efficient, and clearly set out, allowing our team to adapt to the new challenges presented in 2021.

James B., Managing Director

I’ve been really impressed with KlearNow’s product and service, and they took the time to know the requirements of my business.

Harry C. – Director

AS SEEN ON

Resources

Know more. Trade better.

Count on us to keep you informed. Useful guides. Instructive webinars. The latest advice and predictions from our senior team. Updated and free.